Qualified Charitable Distribution (QCD)

Did you know the gift of a Qualified Charitable Distribution (QCD) benefits donors aged 70½ and up?

The Qualified Charitable Distribution is an excellent way to show your support for ECAD and receive tax benefits in return. As you plan your charitable giving for this year, consider using your IRA account to make the most of your charitable giving. You receive a tax benefit even if you take the standard deduction!

It’s important to consider your tax situation before deciding whether to make a charitable contribution from your IRA. Be sure to share this gift plan with your financial advisor.

To qualify

- You must be 70½ or older at the time of gift.

- Distributions must be made directly from a traditional IRA account by your IRA administrator to ECAD. (Click here for a template to help you request the Qualifited Charitable Distribution)

- Gifts must be outright, meaning they go directly to ECAD. Distributions to donor-advised funds or life-income arrangements such as charitable remainder trusts and charitable gift annuities do not qualify.

- Gifts from 401k, 403b, SEP and other plans do not qualify. Ask your financial advisor if it would make sense for you to create a traditional IRA account so you can benefit from an IRA Qualified Charitable Distribution.

Tax Benefits

- IRA Qualified Charitable Distributions are excluded as gross income for federal income tax purposes on your IRS Form 1040.

- The gift counts toward your required minimum distribution for the year in which you made the gift.

- You could avoid a higher tax bracket that might otherwise result from adding an RMD to your income.

Example

Olivia is 71 years old and wants to make a gift to ECAD. She has $500,000 in her IRA and wants to gift $20,000. She can authorize the administrator of his IRA to distribute $20,000 to ECAD. Because the IRA Qualified Charitable Distribution is excluded from income, Olivia will not be eligible for a charitable income tax deduction — but she still receives tax savings.

Questions and Answers

What’s the IRS Rule?

The QCD allows individuals 70½ and older to make direct distributions up to $100,000 per year to 501(c)(3) charities without having to count the distributions as income for federal income tax purposes. No charitable deduction may be taken, but distributions will qualify for all or part of the IRA owner’s required minimum distributions.

Who qualifies?

Individuals 70½ or older at the time of the contribution (you have to wait until 6 months after your 70th birthday to make the transfer).

How much can I distribute?

$100,000 per year. The distribution must be outright to charity. (Click here for a template to help you request the Qualifited Charitable Distribution)

From what accounts can I make transfers?

Distributions must come from your IRAs directly to ECAD. If you wish to help us with a gift from another retirement asset such as a 401k, 403b, etc., you must first roll those funds into an IRA. Then you can direct the IRA administrator to distribute the funds from the IRA directly to ECAD. (Click here for a template to help you request the Qualifited Charitable Distribution)

Can I use the QCD to fund life-income gifts (charitable gift annuities, charitable remainder trusts, or pooled income funds), donor advised funds or supporting organizations?

No, these are not eligible.

How will ECAD count the gift?

We will give you full credit for the entire gift amount. You will also receive a letter, which states that the gift qualifies as a QCD to use for tax reporting purposes.

What are the tax implications to me?

- Federal — You do not recognize the distribution to ECAD as income, provided it goes directly from the IRA administrator to us. Therefore, you are not entitled to an income tax charitable deduction for your gift.

- State — Each state has different laws, so you will need to consult with your own advisors. Some states have a state income tax and will include this distribution as income. Within those states, some will allow for a state income tax charitable deduction and others will not. Other states base their income tax on the federal income or federal tax paid. Some states have no income tax at all.

Does this transfer qualify as my required minimum distribution?

Yes. Once you reach 72, you are required to take required minimum distributions from your retirement plans each year according to a federal formula. QCDs count toward your minimum required distribution for the year in which you make the gift (Note RMDs are not required in 2020).

Can my spouse also make a Qualified Charitable Distribution?

Yes, every individual who is the owner of a traditional IRA can use the Qualified Charitable Distribution for up to $100,000 each year.

How do I know if a Qualified Charitable Distribution is right for me?

Share this information with your financial advisor. Our office can provide additional information and examples of this gift plan.

What is the procedure to execute a QCD?

- We offer a sample letter you can send to your plan provider to initiate the distribution.

- Please let your plan administrator know this gift must be sent prior to December 31 to qualify as a charitable distribution for the tax year.

- Make sure you contact Carrie Picard at [email protected] or (860) 489-6550 when you direct the distribution so we can look for the check from your IRA administrator.

Youth Volunteer

Do you love dogs and being around them? Do you want to see people in need of a Service Dog receive the well-trained dog they deserve? Then the Youth Volunteer Program may be right for you! Here at ECAD, we need volunteers to help us care for our dogs and facilities where we house and train future Service Dogs.

What things will you be doing?

What things will you be doing?

- Cleaning the kennel and crates

- Grooming dogs

- Exercising dogs

- Scooping poop

- And anything else that needs to be completed to ensure the health and welfare of the Service Dogs in Training

When are the volunteer hours?

Currently we are offering this volunteer opportunity on Saturdays and Sundays in three hour shifts from 9am - 12 noon OR 1pm - 4pm. (These are subject to change)

Youth Volunteer Requirements

- Must be between 12-18 years of age

- Be able to follow directions with limited supervision

- Be available on the weekends for a 3 hour shift

- Have reliable transportation and can easily make it to our Torrington, CT campus

- Can commit for a minimum 6 months

What is the process?

What is the process?

1. Complete the volunteer application here

2. Participate in a Phone interview

3. Attend an Orientation

Whether you have service learning requirements through your school/organization or you’re just motivated to volunteer because you like dogs, there may be a place for you here at ECAD. Please note, this is a learn to work volunteer opportunity, where you will learn how to perform kennel responsibilities and basic care for dogs.

What Are Emotional Support Dogs? Emotional Support Animals Explained.

Emotional support animals (ESAs) and trained service dogs are both helpful in assisting people with disabilities. How do they differ? Which one is right for you?

Service dogs and ESAs can completely change the life of a child with autism, a person with an extreme anxiety disorder or a veteran with Post Trauma Stress Disorder (PTSD). They can be the difference between having a meltdown or being able to handle stressful situations; between enjoying independence or living a limited life.

In a country where it’s estimated that more than 20 percent of the population struggles with mental illness, it’s important to understand the value ESAs and service dogs provide. Mental health professionals use the human-animal bond as a component of treatment for these individuals with diagnosed mental illness and psychiatric disorders.

There is very clear research showing that simply the presence of an animal helps reduce daily anxiety, keeps physiological arousal regulated and serves to improve mood. Studies have demonstrated that interacting with a dog, even just looking into its eyes or petting it, can increase beta-endorphins, oxytocin and dopamine—neurochemicals associated with positive feelings and bonding, much like the effects of antidepressants.

Is it a Service Dog or an Emotional Support Animal?

It can sometimes be difficult to distinguish between a service dog and an ESA, especially in relation to assistance with psychological disabilities. The key difference is determining whether or not the animal has a specific task or function related to the handler’s disability. In cases of anxiety attacks, for instance, if the dog has been trained to sense when an anxiety attack is about to start and takes active measures to help avoid or lessen the attack, it is a service dog. If the dog’s presence simply provides comfort to calm a person having an anxiety episode, such as flying on an airplane, it is an ESA.

Looking at the animal’s skill level is another way to distinguish between a service dog and an ESA. For instance, there are certification programs that train guide dogs and hearing dogs to become accustomed to novel stimuli, maneuver through the public, ensure their handler’s safety and alert their handler of any potential dangers. But service dogs can also be trained by their handlers and aren’t required to be certified through a specific program.

Different Treatment Under the Law

There are also legal differences between service dogs and ESAs. Both service animals and ESAs are considered assistance animals as they accompany their handler and assist him or her; however, because of their different legal statuses, the rights of access for ESAs are not as broad as service animals.

Under the ADA, state and local governments, businesses, and nonprofit organizations that serve the public generally must allow service dogs to accompany people with disabilities everywhere the public is normally allowed to go.

ESAs, in contrast, are only legally required to be allowed to accompany their handler on airplanes under the Air Carrier Access Act and be permitted as reasonable accommodations for persons with disabilities under the Fair Housing Act. Both situations require any additional fees that would be charged for accompanying companion animals or pet deposits and fees.

Owners of both service animals and ESAs are subject to charges related to any damages the animal may have caused. This last point is much more important for emotional support dogs, which may not have received any training. Service dogs, in contrast, are almost uniformly extremely well behaved, almost by definition.

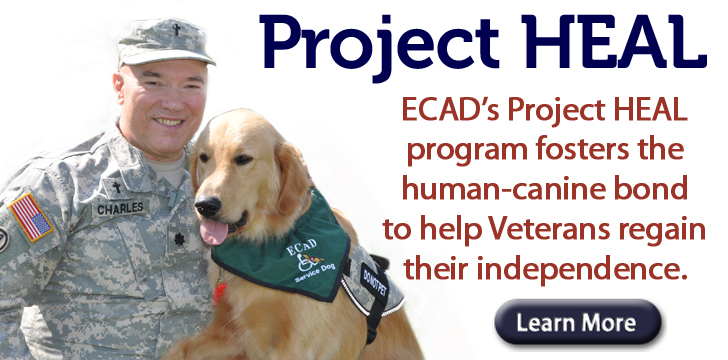

Help Service Dogs Change Lives

If you are considering the impact having a canine companion could have on your life, we would encourage you to consider the training and capabilities a trained Service Dog provides. Learn more about our programs for service dogs for the disabled, service dogs for veterans, and service dogs for children with Autism.

Additionally, providing support to raise and train assistance dogs can change the life of a person living with a disability. It can mean the difference between a life of dependency, living in isolation and being independent and self-sufficient. Your financial contribution or commitment as a volunteer can create miracles!

Help Us Reach Our Goal

10%

ECAD, Educated Canines Assisting with Disabilities is a 501(c)(3) nonprofit organization and we depend on generosity of people like you to continue changing lives.

ECAD Volunteer Opportunities

There are many ways you can be a part of the miraculous process of turning tiny puppies into confident and mature Service Dogs.